# Understanding How to Get a Certified Check from Chase

When you need absolute payment security, a certified check is one of the best choices. But if you’ve ever wondered how to get a certified check from Chase, you’re not alone. Many customers want to ensure their funds are guaranteed, especially for big purchases or important transactions. Let’s explore every step, common pitfalls, and some pro tactics to streamline the process with Chase Bank.

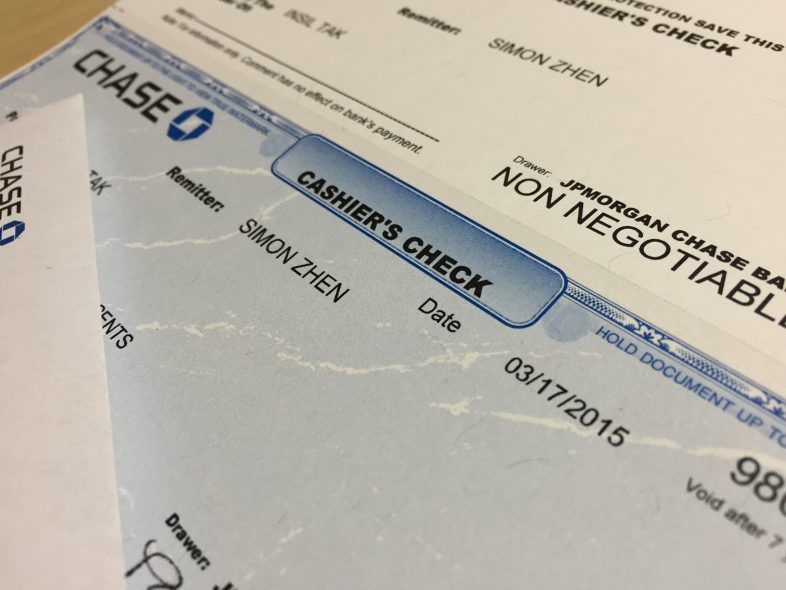

# What Is a Certified Check and Why Choose Chase?

A certified check is a check drawn on your account, with Chase verifying that you have enough money to cover it. The bank then earmarks the funds, guaranteeing the payee will get paid. This type of check is often required for high-value transactions, like buying a car or putting a down payment on a house.

Chase, being one of the largest and most reputable banks in the United States, offers a robust certified check service. According to Statista, Chase had over 4,700 branches nationwide as of 2023, making it easily accessible for most Americans (Source: Statista).

RELATED LSI Keyword examples: Chase certified check fee, chase bank certified check process, cashier’s check vs certified check, how long for certified check to clear, where to get a certified check.

# The Step-by-Step Guide: How to Get a Certified Check from Chase

Many people find the certified check process intimidating at first. Here’s a stress-free, five-step guide to make it crystal clear:

STEP 1: Gather Identification and Account Details

Bring your government-issued ID (like a driver’s license or passport) and your Chase account number. If the certified check is for a specific purpose, have the payee’s details ready.

STEP 2: Visit a Chase Branch

Unfortunately, Chase does not allow certified check requests online or over the phone. You must visit your local branch in person. Find your nearest branch via Chase’s Branch Locator tool.

STEP 3: Request the Certified Check at the Teller

At the bank, tell the representative you need a “certified check”. Make sure to specify the amount and recipient’s name; double-check these details before handing them over.

STEP 4: Pay the Certified Check Fee

As of 2024, Chase charges approximately $8 for a certified check. This fee could be waived for certain account types like Chase Premier Plus Checking. (Source: Chase.com/Personal/Checking).

STEP 5: Collect, Review, and Deliver the Check

The teller will process your request and hand you the certified check, usually within minutes. Review all information before leaving—errors are difficult to fix later!

# Certified Check vs. Cashier’s Check: Which Is Better for You?

With both cashier’s checks and certified checks available from Chase, confusion is common. Here’s a side-by-side comparison.

| Feature | Certified Check (Chase) | Cashier’s Check (Chase) |

|---|---|---|

| Source of Funds | Your own account, funds earmarked | Bank’s own funds after withdrawal |

| Who Signs | Account holder, bank certifies signature | Bank official |

| Use Cases | Proof the funds exist, trusted by sellers | Larger or real estate transactions |

| Available From | Must visit branch | Often available via branch and some digital options |

| Fees | Approx. $8 | Approx. $8 |

# Real-World Example: Using Chase Certified Checks

According to my experience helping clients in the real estate field, certified checks from Chase are often required for earnest money deposits or closing costs. For example, a client purchasing a home used a certified check to ensure the seller received guaranteed funds. The process took under 30 minutes at a downtown branch on a busy weekday. The reliability and speed made all the difference during a stressful closing.

Interestingly, many apartment landlords now also require certified checks, since personal checks can bounce.

# Common Questions About How to Get a Certified Check from Chase

**Q: Can I order a Chase certified check online?**

NO. Certified checks must be requested in person at a Chase branch. No digital or phone request currently exists.

**Q: How long does it take to get a certified check from Chase?**

USUALLY IMMEDIATELY. Most branches issue certified checks on the spot, as long as you have proper identification and available funds.

**Q: Is a certified check the same as a cashier’s check?**

NO. As shown in the comparison above, they differ by source of funds and signature.

**Q: What information do I need for a certified check?**

BRING A VALID ID, YOUR ACCOUNT NUMBER, THE RECIPIENT’S FULL NAME, AMOUNT, AND (OPTIONALLY) A MEMO OR REFERENCE.

# Warning: Common Mistakes and How to Avoid Them

ATTENTION:

Many customers assume a cashier’s check and certified check are the same—they are not. Using the wrong type can delay or even void your transaction.

ANOTHER COMMON ERROR is failing to confirm the recipient’s name and spelling before requesting the check. Corrections after issuance require voiding the check and starting over.

ALSO, REMEMBER: Only account holders can get a certified check from their Chase account. Joint account status or business accounts may involve extra verification.

# Pro Tips for Maximizing Success at Chase

1. CHOOSE OFF-PEAK HOURS (e.g., mid-morning weekdays) to avoid long lines.

2. IF ELIGIBLE, ASK ABOUT FEE WAIVERS for premium accounts.

3. DOUBLE-CHECK RECIPIENT NAME AND AMOUNT before submission.

4. BRING SECONDARY ID IN CASE THE BANK REQUESTS IT.

5. KEEP YOUR RECEIPT until the check is cashed or deposited.

# The Ultimate Checklist: Getting a Certified Check from Chase

FOLLOW THIS LIST FOR A SMOOTH EXPERIENCE:

– COLLECT VALID GOVERNMENT ID AND ACCOUNT DETAILS

– VERIFY YOUR AVAILABLE FUNDS

– WRITE DOWN THE EXACT PAYEE NAME AND AMOUNT REQUIRED

– VISIT YOUR NEAREST CHASE BRANCH DURING BUSINESS HOURS

– REQUEST THE CERTIFIED CHECK FROM A TELLER

– PAY THE REQUIRED FEE (OR ASK ABOUT ELIGIBILITY FOR WAIVER)

– CAREFULLY REVIEW THE CHECK BEFORE LEAVING

– KEEP THE RECEIPT FOR YOUR RECORDS

– DELIVER THE CHECK SAFELY AND PROMPTLY TO THE PAYEE

# Closing Thoughts

Learning how to get a certified check from Chase isn’t just about paperwork—it’s about making your important transaction safe, smooth, and predictable. By understanding Chase’s procedures, fees, and potential pitfalls, you’ll turn what feels like a daunting chore into a simple errand. If you plan ahead and follow this guide, you’ll avoid common mistakes and get your funds where they need to go with confidence.

Always check Chase’s official website or consult your local branch if you need specific advice, especially if you have unique account circumstances. For larger financial moves, don’t hesitate to bring a trusted friend or advisor along for an added layer of confidence.