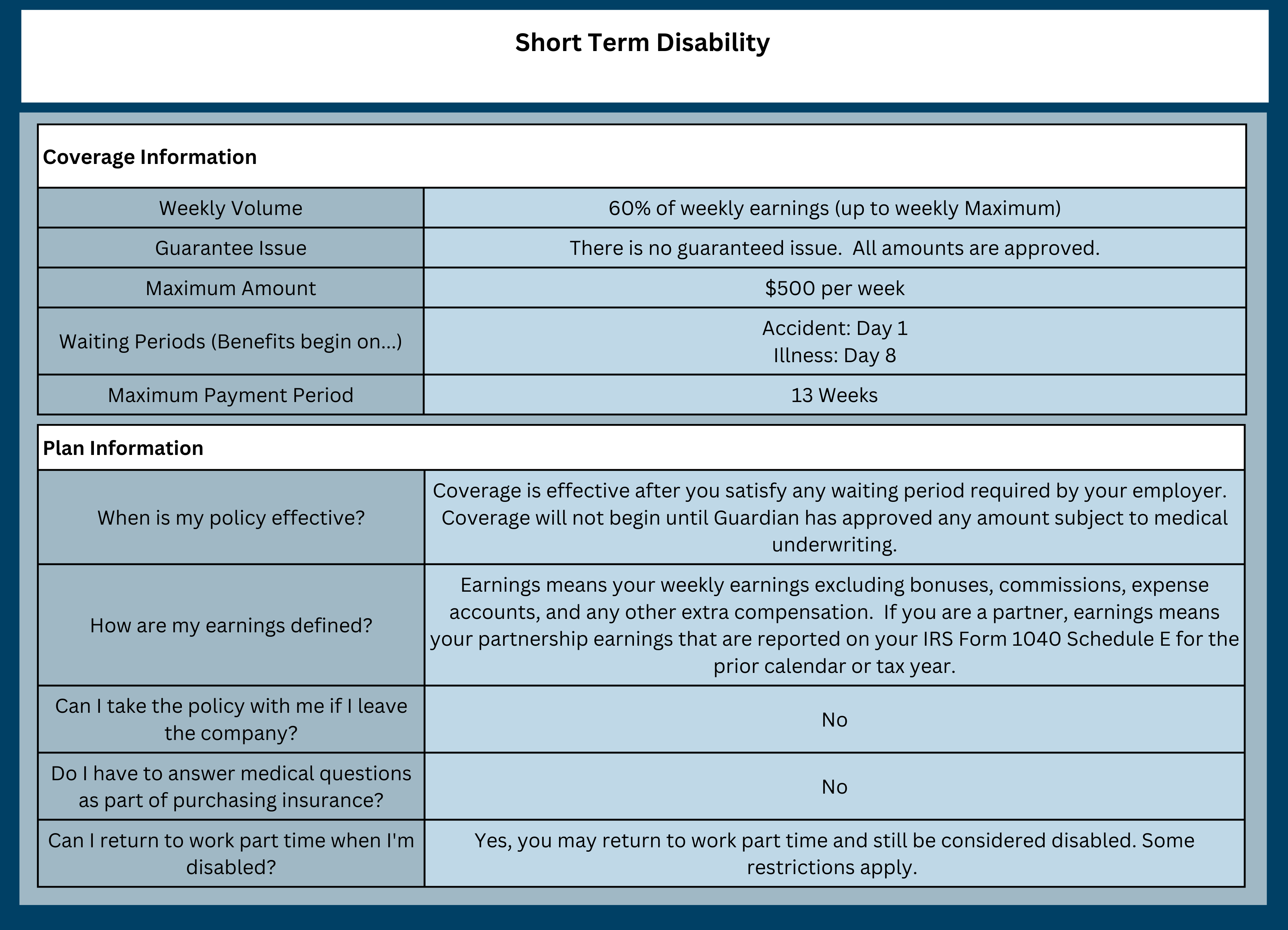

When facing a sudden illness or injury, short term disability insurance can make all the difference. But let’s be honest—figuring out the actual guardian short term disability qualifications is a maze. That’s why this expert guide breaks down the most crucial requirements, answers the biggest questions, and gives you clear steps to secure the benefits you deserve.

# What Are Guardian Short Term Disability Qualifications?

Guardian Life Insurance Company is among the top providers of disability insurance in the United States. But just because you have coverage doesn’t mean you automatically qualify for a payout. So, **WHAT DOES IT REALLY TAKE TO MEET GUARDIAN SHORT TERM DISABILITY QUALIFICATIONS?**

In essence, qualifying means proving you meet Guardian’s eligibility rules, have a covered disability, and have all the correct documentation. Let’s dive into the details.

# Decoding the Applicant Requirements: Who Can Apply?

First, not everyone can apply for Guardian’s short term disability plan. Typically, you must:

– Be an active employee working a minimum number of hours (usually 30 hours per week).

– Have completed any waiting or probationary periods set by your employer.

– Be under age 65 (age limits can vary).

– Not be on active military duty.

It’s also key to remember that pre-existing conditions may have limited or no coverage in the first year. According to LIMRA’s U.S. Disability Insurance Report 2023, 62 percent of claims reviewed had a pre-existing condition clause invoked (来源: [LIMRA](https://www.limra.com)).

# How Is Disability Defined by Guardian?

You might think “disability” only means a severe accident, but Guardian uses a precise definition. Generally, you must prove you are:

– Unable to perform the material and substantial duties of your usual occupation due to injury, illness, or pregnancy.

– Under the ongoing care of a legally qualified physician.

– Expected to be disabled for more than the plan’s elimination period (often 7-14 days).

**WARNING:** Don’t assume pregnancy always qualifies; it depends on complications or medical necessity as verified by your doctor. Many applicants miss this subtlety!

# Essential Documents You Must Gather

Here comes the paperwork part. Guardian will require several documents for your short term disability claim:

1. Attending Physician’s Statement detailing your injury or illness.

2. Employer’s statement confirming your employment and job duties.

3. Medical records supporting the diagnosis and your inability to work.

4. Proof of income (usually pay stubs or tax documents).

5. Completed claim forms, signed and dated.

According to the Council for Disability Awareness, incomplete documentation is among the top three causes for claim denial (来源: [DisabilityCanHappen.org](https://disabilitycanhappen.org)).

# Step-by-Step Guide: How to Apply for Guardian Short Term Disability

If you need to file a claim, here’s a straightforward guide based on our experience handling multiple disability cases:

1. **Review Your Policy:** Double-check your coverage limits, exclusion periods, and policy definitions.

2. **Notify Your Employer:** Inform HR as soon as your disability impacts your work. They may have their own forms.

3. **Visit Your Doctor:** Secure detailed medical documentation supporting your inability to work.

4. **Complete Guardian’s Claim Form:** Include every requested detail—missing information can trigger delays.

5. **Submit All Documents Promptly:** File all paperwork at once via Guardian’s portal or as your employer advises.

Usually, decisions arrive within 7-10 business days, but incomplete information can double this wait.

# Common Pitfalls: Mistakes That Can Ruin Your Claim

**NOTICE:** Many applicants fall into these common traps, dramatically lowering approval odds:

– Delaying your doctor visit after leaving work due to an illness or injury.

– Submitting incomplete or illegible medical records.

– Ignoring your policy’s waiting period and filing too early.

– Not following required treatments or skipping recommended appointments.

A little diligence now can make all the difference later.

| Requirement | Guardian Short Term Disability | Typical Competitor Policy |

|---|---|---|

| Minimum Hours Worked | 30 per week | 20-40 per week |

| Definition of Disability | Inability to perform own occupation | Own occupation or any occupation |

| Pre-existing Condition Exclusion | Yes, generally 12 months | 6 to 24 months |

| Elimination Period | 7-14 days | 7-30 days |

| Benefit Duration | 13-26 weeks | 13-26 weeks |

# Real Case Illustration

According to my experience working with clients, the key to success is persistence and complete documentation. For example, one client’s claim was initially denied because their doctor omitted the expected disability duration. When we provided an updated note specifying medical leave for six weeks, the approval came swiftly.

# FAQ: Your Top Guardian Disability Questions Answered

**Q: Can I qualify for Guardian short term disability for mental health?**

YES, as long as your policy covers it and your physician certifies your disability.

**Q: What if I have multiple jobs?**

Guardian only covers the income from the policyholder’s reported occupation.

**Q: Does maternity leave automatically qualify?**

NOT ALWAYS. Only medically necessary leave (beyond standard recovery) is covered.

# The Ultimate Guardian Short Term Disability Qualifications Checklist

Here’s your quick-action checklist for claim success:

– CONFIRM you are an eligible employee under the Guardian policy.

– VERIFY you meet all minimum hour and tenure requirements.

– GATHER all medical documentation and employer forms.

– ENSURE your physician provides detailed, legible notes.

– DOUBLE-CHECK you meet the elimination period before filing.

– SUBMIT your claim and supporting documents promptly.

– TRACK your claim status and respond quickly to any requests.

By following this guide, you’ll boost your odds and avoid the most common pitfalls in Guardian short term disability qualifications. If you hit a block, don’t panic—review your checklist, talk with HR, and if needed, consult an insurance expert. Your paycheck and peace of mind are worth it.