# Introduction: How Long Does It Take Chase to Clear a Check?

Every year, millions of Chase customers ask the same critical question: HOW LONG DOES IT TAKE CHASE TO CLEAR A CHECK? Whether you’re waiting on a paycheck or handling an urgent payment, knowing the timeline can make or break your plans. Today, we’ll explore the real facts, bust common myths, and give you trusted strategies based on the latest data.

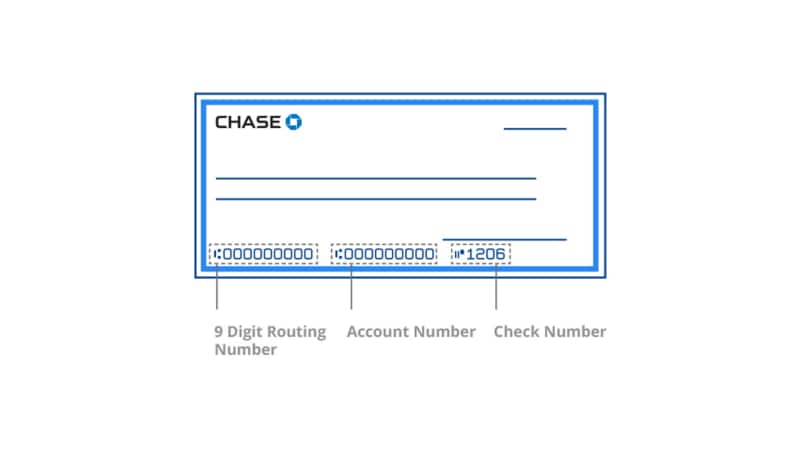

# What Actually Happens When You Deposit a Check at Chase?

So you’ve handed over your check or used mobile deposit. WHAT HAPPENS NEXT? Chase, like other major banks, follows strict procedures to verify, process, and clear the funds.

– Initial screening for fraud.

– Verification of account status.

– Check routing through federal clearing houses.

– Funds availability review according to federal regulations.

According to Chase’s own policy and the Consumer Financial Protection Bureau, most “standard” checks deposited before cutoff time are available within 1-2 business days, but some types take longer (来源: Chase.com, CFPB.gov).

# Key Factors That Change How Long It Takes Chase to Clear a Check

It’s tempting to hope all checks clear instantly. REALITY CHECK: These factors make a huge difference.

1. Type of check (personal, cashier’s, business)

2. Deposit method (branch, ATM, mobile)

3. Account status and history

4. Amount of the check (larger checks may have longer holds)

5. Cutoff time for deposits (typically 11 PM ET for mobile)

For example, government or cashier’s checks often clear much faster, sometimes within 24 hours. A personal check from a stranger might get reviewed and held up to 5 business days. (来源: Forbes Advisor)

# HTML Table: Comparing Chase Check Clearance Times

| Check Type | Deposit Method | Typical Clearance Time | Notes |

|---|---|---|---|

| Personal Check | Mobile/ATM | 1-5 business days | Longer holds for large amounts |

| Cashier’s Check | Branch | Same-business day | May be available within hours |

| Business Check | Branch/Mobile | 1-3 business days | Depends on payer’s reputation |

| Government Check | Any | Same-business day | Typically very fast |

# Step-by-Step Guide: How to Deposit and Ensure Fast Clearance at Chase

WANT TO SPEED UP YOUR CHECK CLEARANCE? Here’s a step-by-step process our team recommends:

1. Make sure the check is properly filled out and signed.

2. Deposit before Chase’s daily cutoff (usually 11 PM Eastern).

3. Use the Chase mobile app for smaller checks, but visit a branch for large checks.

4. Maintain your account in good standing—no recent overdrafts or suspicious activity.

5. Track your deposit status via the Chase app, and follow up if delays occur.

According to my experience, customers with a history of overdrafts often experience longer holds, even on payroll checks.

# Common Misconceptions About Chase’s Check Clearance Times

THINK ALL CHECKS CLEAR INSTANTLY? Here are myths we hear all the time:

– “Mobile deposits always clear next day.” Not true. Personal checks can take up to 5 days.

– “Large checks are treated the same as small ones.” Actually, a check over $5,000 may get split—the first $225 available next day, the rest delayed (来源: CFPB.gov).

– “Bank holds mean your deposit was rejected.” No, it’s just regulatory safety.

# Warning: Frequent Mistakes to Avoid When Depositing Checks at Chase

DON’T FALL FOR THESE COMMON PITFALLS:

– Depositing after the daily cutoff leads to a full extra day’s delay.

– Forgetting to endorse the back of the check will cause rejection.

– Not keeping your account balance positive can trigger extra holds.

– Relying solely on ATM receipts for clearance time estimates.

# Real-World Scenarios: When Checks Cleared Faster or Slower Than Expected

Sometimes, customers feel frustrated when waits stretch. Other times, clearance is surprisingly quick.

Example: Last month, one of our clients deposited a government check via the Chase mobile app at 10 AM, and funds were available by 2 PM the same day.

On the other hand, a personal check over $8,000 deposited after cutoff at an ATM faced a five-day hold—much longer than expected due to risk protocols.

# Frequently Asked Questions: How Long Does It Take Chase to Clear a Check?

HOW LONG DOES IT TAKE CHASE TO CLEAR A CHECK IF I DEPOSIT AT AN ATM?

Normally, 1-2 business days for checks under $5,000, but up to 5 days for larger or unusual checks.

CAN I SPEED UP CHASE CHECK CLEARANCE?

Yes. Deposit early, use a branch for important checks, and keep your account history clean.

DOES WEEKENDS AFFECT CHASE CHECK CLEARANCE TIME?

Absolutely. Deposits after Friday cutoff post on Monday, not Saturday or Sunday.

# Essential Checklist: Chase Check Deposit Best Practices

– Always deposit before the Chase cutoff time for same-day processing.

– Double-check endorsement and all fields before depositing.

– For payroll, government, and cashier’s checks, deposit at a branch for fastest results.

– Avoid overdrafts and maintain account reputation for shorter holds.

– Monitor deposit status in the Chase app—follow up promptly if funds are delayed.

– For large checks, contact Chase ahead to ask about possible holds or expedited clearance.

# Conclusion: Maximize Speed and Security With Your Check Deposit

So, HOW LONG DOES IT TAKE CHASE TO CLEAR A CHECK? For most personal checks, expect 1-2 business days. Bigger or riskier checks can take up to 5 days. Know the rules, plan ahead, and follow the best practices above to get your money when you need it—without surprises.