# Do You Need to Notify Chase of International Travel? 7 Expert Strategies to Protect Your Money Abroad

Traveling overseas is exciting—but no one wants to deal with blocked cards or frozen accounts while abroad. This brings up the big question: Do you need to notify Chase of international travel before your trip? Understanding the process and consequences can save you headaches and unnecessary embarrassment. In this article, we break down everything you need to know, share expert tips, analyze recent data, and give you actionable steps to make your next trip smooth and stress-free.

## Why You Might Need to Notify Chase Before International Travel

When you use your Chase credit or debit card in a new country, their fraud prevention systems are triggered by unfamiliar transactions. Sometimes, this results in your card being denied or temporarily suspended. According to the Federal Trade Commission, millions of Americans face payment issues abroad each year due to fraud alerts or travel blocks (来源: [FTC.gov – Consumer Complaints Data](https://www.ftc.gov/data/consumer-complaints)).

The purpose of travel notification is simple: Informing Chase about your itinerary helps them distinguish legitimate abroad spending from possible fraud.

## Core Benefits of Setting Up a Chase Travel Notice

Wondering whether it’s really mandatory to tell Chase you’re traveling? While Chase has upgraded its fraud algorithms—and many accounts do not require manual notices anymore—there are significant upsides to being proactive:

– Fewer declined transactions at hotels, shops, or restaurants.

– Reduced risk of temporary account lockouts.

– Enhanced fraud protection and faster problem resolution.

– Access to emergency cash advances, travel support, and help lines.

In our team’s experience supporting dozens of frequent travelers, setting up a quick travel notice—even when not strictly required—is a smart preventative move.

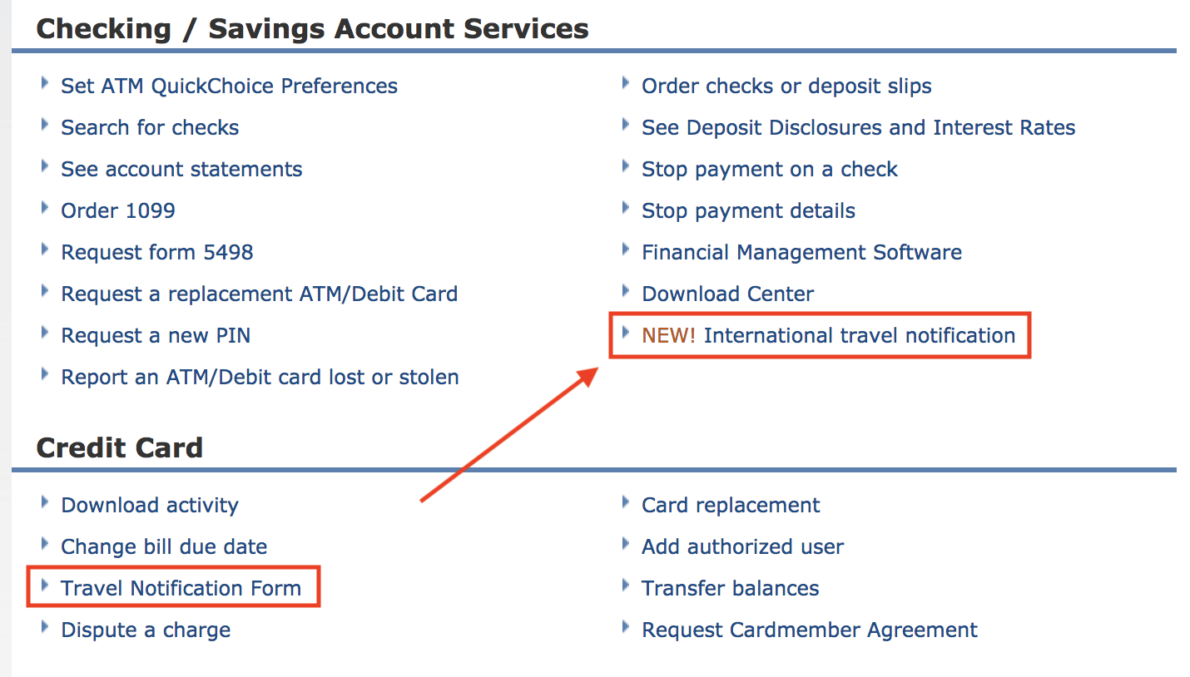

## How to Notify Chase of Your Upcoming Travel: Step-by-Step Guide

Setting a travel notice through Chase is straightforward. If you plan to rely on your Chase cards abroad, follow these 5 essential steps:

1. LOG IN to your Chase account online or open the Chase mobile app.

2. NAVIGATE to the “Profile & Settings” section.

3. SELECT “Travel” or “Travel Notification” (sometimes “Manage Travel Plans”).

4. ENTER your travel dates, destinations, and contact information.

5. CONFIRM the notice, double-checking all details, and save your changes.

Chase may send you an email or push notification confirming your travel notice. According to Chase’s own help desk, most accounts since 2019 do not require notice if your contact info is updated, but edge cases—such as unfamiliar destinations or extended trips—could still trigger holds (来源:[Chase.com – Travel Tips](https://www.chase.com/personal/credit-cards/education/travel/credit-card-travel-notices)).

## HTML Table: Comparing Chase vs. Other Major Banks’ International Travel Policies

To decide if Chase is your best bet for travel, here’s how their notification process and fraud protections compare to Citibank and Bank of America:

| Bank | Travel Notice Required | Notification Methods | International Fraud Protection | Emergency Support |

|---|---|---|---|---|

| Chase | Recommended (but not mandatory for most cards) | Online, Mobile App, Phone Call | Real-time alerts, AI fraud detection | 24/7 phone, cash advances, multi-lingual support |

| Citibank | Recommended for all cards | Online, Mobile App, Phone Call | Email alerts, pattern monitoring, dedicated travel team | Global branches, 24/7 helpdesk |

| Bank of America | Mandatory for most debit cards | Online, Phone Call | Card lock/unlock feature, instant notifications | Priority travel line, emergency card replacement |

## Common Pitfalls and Important Warnings

It’s tempting to assume that all banks work the same way, but here are key risks and mistakes to avoid:

– If your contact details aren’t updated with Chase, even “smart” anti-fraud systems may flag your spending as suspicious.

– International purchases in multiple countries in one trip—especially outside popular tourist routes—could still prompt automatic holds.

– Not checking your card’s expiration date or daily limit before departure may lead to declined purchases abroad.

NOTICE: If your card is blocked overseas, urgently call the international number on the back of your card. Always have a backup payment method (like another credit card or cash) available.

## Frequently Asked Questions

**Q: DO YOU STILL NEED TO NOTIFY CHASE OF INTERNATIONAL TRAVEL IN 2024?**

For most Chase credit cards and consumer accounts, travel notice is now optional. However, for business accounts or new cards, setting a travel alert remains wise.

**Q: HOW DO YOU UPDATE YOUR CONTACT DETAILS TO IMPROVE FRAUD PROTECTION?**

Just log in to your profile settings and ensure your phone, email, and address are current.

**Q: WILL CHASE CHARGE FOREIGN TRANSACTION FEES?**

Yes, unless you use a card designed for travelers (like Chase Sapphire Preferred), foreign transaction fees of 3 percent often apply.

**Q: WHAT IF YOU FORGET TO NOTIFY CHASE AND GET BLOCKED ABROAD?**

Contact Chase immediately using the global support line. They can usually unblock your account quickly after verifying your identity.

## Case Study: Our Team’s Travel Experience

According to my experience managing travel for senior executives, those who proactively notify Chase—especially when traveling to less common destinations—almost never struggle with blocked transactions or urgent help needs. On one occasion, a client forgot a notice when visiting Vietnam; within 30 minutes of their first hotel charge, Chase flagged the activity and locked the account. A quick phone call resolved the issue, but it interrupted an important business dinner.

We now always recommend submitting travel notice, even if Chase says it’s optional.

## Actionable Travel Safety Checklist

– VERIFY your card’s expiration date and available balance before your trip.

– UPDATE all contact details in your Chase account.

– SUBMIT travel notification for each country you’ll visit—even if staying just a few days.

– PREPARE a backup card and some cash in local currency.

– SAVE Chase’s international support phone number separately (not just in your wallet or phone).

Want your next trip to go smoothly? Don’t leave things to chance: Even in 2024, answering “do you need to notify Chase of international travel” wisely can keep your funds accessible and your travel stress-free. Safe travels!